Unlock Your Business's Profit Potential with the Momentum-Maker Mastermind

If you are a small business owner who wants to take your business to the next level, increase your impact, and income… Join our Next "Momentum-Maker" LIVE Session FREE

The Next Live Session is on: April 12th @9:45 AM (Pacific Time)

Our Services

Kirk Jaffe Enterprises, Inc. has multiple services for home buyers and business owners.

Make us your preferred solution for home and commercial real estate.

MORTGAGE LENDING

We offer the most competitive rates and excellent service beyond closing. Guaranteed! PRO.

REAL ESTATE AND PROFESSIONAL CONSULTING

We offer guidance to real estate professionals, tax professionals, lawyers, and CPA's.

BUSINESS CONSULTING

Are you ready to grow your business to

the next level and beyond. Kirk has helped hundreds of businesses and

can help you get there faster.

INVESTMENT ASSISTANCE

Our proven track record in solid investments has help hundreds and could help you too. Ask us how!

FIND OUT WHY KIRK JAFFE IS THE BEST CHOICE FOR LOANS AND HELPING BUSINESSES GROW!

Kirk Jaffe, CEO/Founder – Executive Management of $200MM private investment fund including Mortgage Notes, Real Estate Owned (REO) and Commercial Property Holdings. He has overseen and held executive authority of over 20,000 real estate transactions in his 20-year real estate career including buying and selling of property, foreclosure, short sale, loan modification, rehabilitation of property with an aggregate over $1 Billion value. Kirk has also originated over $ 1 Billion of new Mortgages.

Kirk is the past President of the Universal City/North Hollywood Chamber of Commerce as well as a former co-chair of the ALFN Commercial Practices Committee. He is active as a speaker and moderator of several trade organizations including the CA Mortgage Bankers Association (CMBA), Mortgage Banking Association (MBA), and the Attorney Legal Financial Network (ALFN). Mr. Jaffe is quoted or has been a guest of several media outlets including: KABC790 Talk Radio, NBC and the Los Angeles Daily News to name a few.

Kirk Has Appeared On:

How Can We Help

You Today?

Start Quote

Change Plan

Contact

Let Us Know What You Need!

We custom fit every service to your personal business needs. Whatever it is, we have a solution. Just click the button below to get assistance today!

If you're looking for a firm who can help you with not just your mortgage, but help you GROW YOUR BUSINESS FAST... you're where you should be!

MORTGAGE LENDING

We offer Custom Tailored mortgages for Home or Business!

BUSINESS CONSULTING

Grow your business FAST with our Business Consulting Services!

INVESTMENT CONSULTING - REAL ESTATE ASSETS

Our win/win approach to investing has helped hundreds. FIND OUT MORE!

REAL ESTATE PROFESSIONALS

If you are a real estate professional and are ready to work with a partner with years of experience, you're in the right place.

CPAS, ATTORNEYS, AND INSURANCE PROFESSIONALS

If you have questions about the potential legal implications of real estate transactions for your clients, Kirk Jaffe has the answers!

GET STARTED TODAY

Getting started with Kirk Jaffe Enterprises is super easy. Find out how it works below!

WHAT OUR CLIENTS HAVE TO SAY

“What a GREAT guy Kirk is! I highly recommend him and his services all the time and for my own home loan needs. Why would I say that as a Broker myself? Well as a Buyer and a Broker I cannot have my hand into many aspects of the transaction, so I trust Kirk with my financing needs he has yet to let me down! "

Steve Duncan

"Kirk is my go-to lender. He has worked many “miracle situations” and provides top notch service from start to finish...."

Jeff J. Grice

"I have known Kirk Jaffe for many years. Kirk has a stellar reputation. You can see his reviews by going to www.mycity.com/profile/kirk-jaffe."

Bob Friedenthal

"When I need any information regarding the Real Estate Financing space for a client, my first call is to Kirk Jaffe. He is knowledgeable, professional, and experienced. He stays on top of cases and follows up with clients. He is a true asset to my business."

Bruce Fine

"Kirk works hard and well day and night, a kind person and gets it done fast!"

Melissa Oppenheimer

"Kirk did a fabulous job. He walked me thru the process and it was incredibly easy compared to other mortgages I've done. Thanks to Kirk, my house closed in under 21 days, and he got me a great interest rate."

CHARLIE JEWETT

WHY WORK WITH KIRK JAFFE ENTERPRISES, INC?

Because we offer the best service at affordable rates and will help your company grow faster! Click the button or

CALL US AT (775) 415 - KIRK (5475)

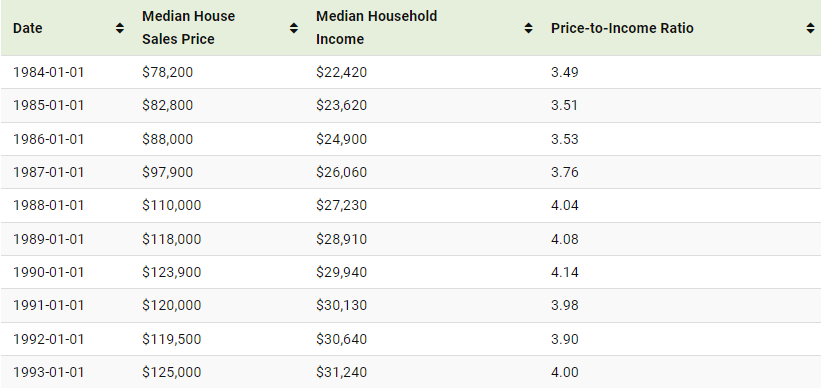

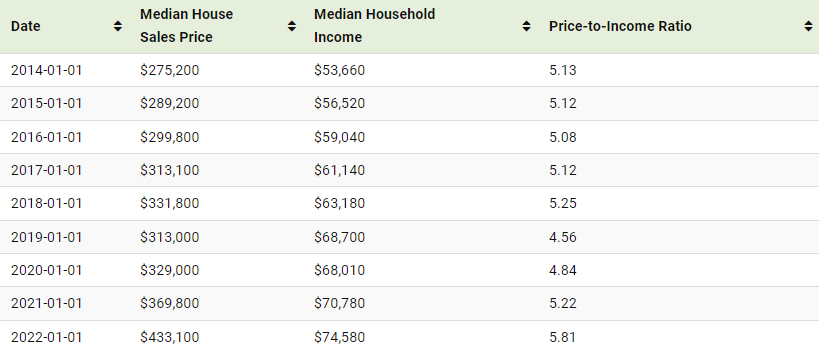

Charted: U.S. Median House Prices vs. Income

Houses in America Now Cost Six Times the Median Income

As of 2023, an American household hoping to buy a median-priced home, needs to make at least $100,000 a year. In some cities, they need to make nearly 3–4x that amount.

The median household income in the country is currently well below that $100,000 threshold. To look at the trends between median incomes and median house prices through the years, we charted their movement using the following datasets data from the Federal Reserve:

Median household income (1984–2022).

Median Sales Price of Houses Sold (1963–2023).

Importantly this graphic does not make allowances for actual household disposable income, nor how monthly mortgage payments change depending on the interest rates at the time. Finally, both datasets are in current U.S. dollars, meaning they are not adjusted for inflation.

Timeline: Median House Prices vs. Income in America

In 1984, the median annual income for an American household stood at $22,420, and the median house sales price for the first quarter of the year came in at $78,200. The house sales price-to-income ratio stood at 3.49.

By pure arithmetic, this is the most affordable houses have been in the U.S. since the Federal Reserve began tracking this data, as seen in the table below.

A hidden caveat of course, was inflation: running rampant towards the end of the 70s and the start of the 80s. While it fell significantly in the next five years, in 1984 the 30-year fixed rate was close to 14%, meaning a significant chunk of household income went to interest payments.

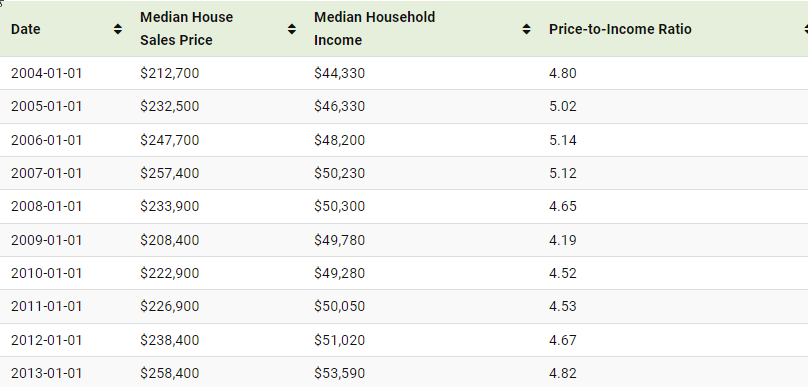

Note: The median house sale price listed in this table and in the chart is from the first quarter of each year. As a result the ratio can vary between quarters of each year.

The mid-2000s witnessed an explosive surge in home prices, eventually culminating in a housing bubble and subsequent crash—an influential factor in the 2008 recession. Subprime mortgages played a pivotal role in this scenario, as they were issued to buyers with poor credit and then bundled into seemingly more attractive securities for financial institutions. However, these loans eventually faltered as economic circumstances changed.

In response to the recession and to stimulate economic demand, the Federal Reserve reduced interest rates, consequently lowering mortgage rates.

While this measure aimed to make homeownership more accessible, it also contributed to a significant increase in housing prices in the following years. Additionally, a new generation entering the home-buying market heightened demand. Simultaneously, a scarcity of new construction and a surge in investors and corporations converting housing units into rental properties led to a shortage in supply, exerting upward pressure on prices.

As a result, median house prices are now nearly 6x the median household income in America.

How Does Unaffordable Housing Affect the U.S. Economy?

When housing costs exceed a significant portion of household income, families are forced to cut back on other essential expenditures, dampening consumer spending. Given how expanding housing supply helped drive U.S. economic growth in the 20th century, the current constraints in the country are especially ironic.

Unaffordable housing also stifles mobility, as individuals may be reluctant to relocate for better job opportunities due to housing constraints. On the flip side, many cities are seeing severe labor shortages as many lower-wage workers simply cannot afford to live in the city. Both phenomena affect market efficiency and productivity growth.

©VisualCapitalist

CONTACT US TODAY

Need to reach us? Send us an email or give us a call today.

Kirk Jaffe Enterprises, Inc.

195 Highway 50, Ste 104-476

Stateline, NV 89449